This week, the latest estimates on tablet market trends from IDC showcase a dramatic shift in consumer preferences and market dynamics. With Android tablet growth accelerating impressively, this platform now commands an impressive 56.5 percent market share, overshadowing the iPad’s declining foothold of less than 40 percent. Meanwhile, Windows tablet challenges persist, dragging their market presence down to just under 4 percent, sparking concerns about the future of these devices. Additionally, notable tablet sales statistics indicate a surge in demand for affordable tablets in emerging markets, making it clear that low-cost manufacturers are poised to thrive. As we delve deeper into these figures, the implications for major players like Apple and Microsoft become increasingly significant on the horizon of the technology landscape.

This week, we take a closer look at the evolving landscape of the digital slate market, where significant transformation is underway. The rapid ascent of budget-friendly Android devices is reshaping how consumers engage with tablet computing, contrasting sharply with the iPad’s dwindling presence. Meanwhile, the Windows platform grapples with persistent hurdles, contributing to a notable share in the broader market. Recent data reveal striking sales figures that highlight a growing appetite for tablets, particularly in developing regions, underscoring a trend towards accessibility and affordability. As we analyze these pivotal shifts, the implications for traditional tech giants become more pronounced, signaling a new era of competition and opportunity.

The Rise of Android Tablets

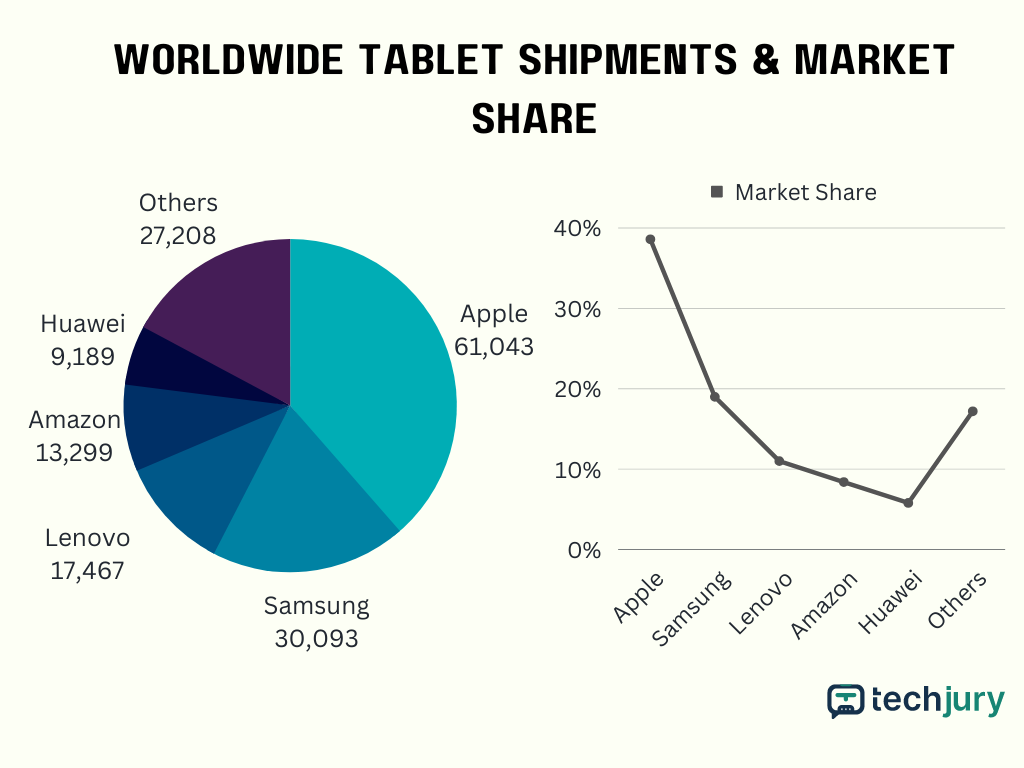

The tablet market has witnessed a significant shift in dynamics, with Android tablets overtaking the iPad as the leader. This growth can be attributed to the expanding range of devices offered by various manufacturers, with Android currently commanding a substantial 56.5 percent market share. The factors contributing to this trend include the affordability of Android tablets and their accessibility in emerging markets, which has led to a surge in demand among consumers seeking cost-effective solutions. As a result, this shift mirrors the competitive landscape seen in the smartphone sector, where Android established its dominance over iOS.

Moreover, the performance of manufacturers like Samsung and Asus has played a pivotal role in this growth. Samsung’s strategic product releases and marketing efforts have enabled it to secure significant sequential gains. Additionally, the performance of other regional Android tablet players, categorized as ‘Other Android Tablets,’ is notable. These devices are often positioned as mid-range to low-cost alternatives, meeting the demand of price-sensitive consumers. The Android operating system’s flexibility allows these brands to deliver “good enough” products, further cementing Android’s position in the market.

iPad Market Share Decline

In stark contrast to the rise of Android tablets, the iPad has experienced a decline in market share, now falling below 40 percent. This downturn is particularly worrying for Apple, as their tablet shipments are forecasted to drop further, especially in the absence of new product launches prior to Q4. The company’s reliance on seasonal sales spikes, typically driven by product introductions, puts the iPad at risk of ongoing declines, particularly when competitors are innovating rapidly. CEO Tim Cook’s recent statements during earnings calls have alluded to a strategic focus on upcoming releases, which may leave Apple vulnerable in the interim.

The implications of this decline are substantial, not only for Apple but also for the industry at large. As Android tablets gain traction from both mid-range and budget brands, the competition is expected to become fiercer. The trend suggests that iPad sales could further dwindle, particularly as emerging markets continue to push the demand for affordable tablets. With Android tablets often being perceived as satisfactory alternatives, the iPad’s exclusivity may fail to entice a broader audience, resulting in challenges for Apple’s market position.

Challenges Faced by Windows Tablets

Windows tablets continue to grapple with significant challenges, holding a meager market share of under 4 percent. The resistance against Windows tablets partly stems from consumer hesitation to adopt a platform that is often perceived as less optimized for tablet usage compared to Android and iOS ecosystems. Furthermore, the diminishing appeal of Windows 8/RT tablets is indicative of a broader reluctance among users to transition away from traditional laptops and desktops towards tablet devices that lack compelling unique features.

Despite efforts to revamp the Windows tablet lineup, manufacturers are struggling to achieve meaningful growth in shipments, raising concerns over overall sell-through rates. This stagnation can be attributed to a lack of innovative product offerings that resonate with consumers, particularly in the face of aggressive pricing and features from Android competitors. As a result, the Windows tablet segment appears positioned for continued challenges unless there are significant advancements or shifts in strategy from Microsoft and its associated hardware partners.

Tablet Sales Statistics and Market Insights

Recent sales statistics highlight a pronounced divergence in performance across brands and platforms within the tablet market. IDC’s latest estimates indicate that Android tablets have not only solidified their lead, but they are also on track to surpass the 60 percent market share threshold shortly. This projection underscores the rising popularity of affordable tablets tailored for an emerging audience, particularly in low-income regions where budget constraints dictate purchasing decisions.

Conversely, the statistics paint a sobering picture for the iPad and Windows tablets. While iPad sales typically experience a boost in the second quarter, this period may see declines as Apple anticipates product releases only later in the year. The data reflects broader trends that could negatively impact the PC market as well, given that consumers may increasingly prefer to opt for multifunctional, cost-effective tablets over traditional laptops. This paradigm shift signifies a pivotal moment for manufacturers as they reevaluate their strategies and product offerings in light of these evolving trends.

Emerging Market Demand for Tablets

The surge in demand for tablets in emerging markets is reshaping the landscape of the tablet industry and driving growth in a previously untapped consumer base. As disposable incomes rise and internet accessibility improves, consumers in these regions are turning to affordable Android tablets to meet their digital needs. This trend is significantly benefiting lower-cost manufacturer’s products, allowing them to carve out market share in locations that were historically dominated by more expensive brands.

Emerging markets present immense potential for growth, as buyers typically prioritize value and functionality over brand loyalty. Companies that can adapt quickly and provide targeted solutions that resonate with local populations are likely to thrive. The focus on low-cost devices capable of performing essential tasks—from educational use to entertainment—illustrates an important shift towards widespread tablet utilization in non-traditional markets.

Future Predictions for the Tablet Market

Looking ahead, market predictions suggest that the competition among tablet manufacturers is only expected to intensify. The continued dominance of Android tablets, fueled by their affordability and adaptability, implies that Apple will need to innovate more aggressively to regain lost ground in market share. Analysts foresee potential challenges as the product cycles of various brands begin to influence consumer purchasing decisions significantly.

As the tablet landscape evolves, manufacturers must remain vigilant about emerging trends and shifting consumer preferences. Features such as enhanced usability, longevity, and ecosystem integration will become increasingly crucial. Moreover, the demand for multifunctional devices capable of serving multiple use cases will shape the development strategies of manufacturers competing for market dominance. This dynamic environment will require continuous adaptation and strategic foresight as companies navigate the complex tablet market landscape.

Consumer Preferences in Tablet Selection

Understanding consumer preferences is vital for manufacturers aiming to capture a larger share of the tablet market. As technological advancements occur, consumers have become more discerning, evaluating not only the brand but also the features, price, and usability of tablets. Factors such as display quality, battery life, and the operating system play a significant role in shaping purchase decisions. Furthermore, the rise of social media and online reviews has enabled consumers to make informed choices, thus exerting pressure on manufacturers to enhance their offerings continually.

Additionally, the demand for seamless integration with other devices is becoming paramount. Consumers increasingly expect their tablets to work in harmony with their smartphones and laptops. This has led to a notable emphasis on ecosystem compatibility, with brands that can offer a seamless experience often having the upper hand. Consequently, manufacturers must invest in creating interconnected products that enhance user experience to meet evolving consumer expectations.

The Role of Product Innovation in Tablet Sales

Innovation continues to be a driving force behind tablet sales, as manufacturers strive to differentiate their products amid intense competition. Whether through hardware advancements, such as improved processors and displays, or software enhancements that provide unique functionalities, innovative offerings are critical for attracting consumers. Brands that prioritize research and development will likely achieve greater market success by addressing niche needs while appealing to mainstream consumers.

Moreover, product innovation must extend beyond the technical specifications to encompass user experience and design elements. Manufacturers that focus on providing intuitive interfaces, versatile use cases, and aesthetic appeal stand a better chance of securing consumer loyalty. As the market becomes increasingly competitive, those brands that succeed in delivering a blend of performance, value, and innovation will shape the future of the tablet industry.

Global Distribution Strategies for Tablets

Effective global distribution strategies play a crucial role in maximizing sales opportunities in the tablet market. With the rise of e-commerce, manufacturers now have the ability to reach consumers worldwide without relying on traditional retail channels. Understanding regional preferences and establishing localized distribution networks can give brands a distinct competitive edge. Companies that can tap into the online shopping trend will be poised to capture the growing consumer base across the globe.

Additionally, strategic partnerships with local distributors can enhance reach and facilitate quicker market entry. Tailoring marketing approaches based on consumer demographics and regional behavior enables brands to resonate more with targeted audiences. As competition heightens, developing comprehensive distribution strategies that encompass both online and offline channels will be essential for tablet manufacturers to thrive in increasingly saturated markets.

Frequently Asked Questions

What are the latest tablet market trends as of 2023?

The latest tablet market trends indicate a strong dominance of Android tablets, which now hold a 56.5% market share, surpassing the iPad’s share which has fallen below 40%. Emerging markets are seeing increased demand for low-cost Android tablets, significantly impacting overall tablet sales statistics.

How is Android tablet growth impacting the iPad market share?

Android tablet growth has dramatically impacted the iPad market share by capturing a larger segment of consumers, particularly in emerging markets. As Android tablets continue to outperform the iPad, Apple’s market share is experiencing a notable decline, contributing to a competitive tablet market landscape.

What challenges do Windows tablets face in the current tablet market?

Windows tablets are experiencing significant challenges, holding less than 4% of the tablet market share. These challenges stem from slower shipment figures and competition from the rapidly growing Android tablet sector, which has redefined market dynamics.

What do tablet sales statistics indicate about the future of the tablet market?

Tablet sales statistics show a consistent increase in Android tablet sales, particularly in emerging markets, suggesting a shift in consumer preference towards affordable devices. This trend indicates a potential for Android tablets to further solidify their market dominance and possibly exceed 60% market share in the coming quarters.

What is driving emerging market demand for Android tablets?

Emerging market demand for Android tablets is primarily driven by low-cost options that meet basic consumer needs, making technology more accessible. These trends suggest that as more regional manufacturers produce affordable Android tablets, demand will continue to rise, further challenging established brands like Apple and Microsoft.

| Tablet Brand | Market Share | Key Observations |

|---|---|---|

| Android Tablets | 56.5% | Dominating over iPad; demand in emerging markets surging. |

| iPad | Struggling to maintain market share; likely to drop further. | |

| Windows Tablets | Facing significant challenges; concern over sell-through rates. | |

| Samsung | Leading Android OEM | Significant gains in shipments; strong performance. |

| ‘Other Android Tablets’ | Various regional players | Good enough products at low price points gaining traction. |

Summary

Tablet market trends indicate a significant shift in leadership, with Android tablets now dominating the market with a 56.5% share, while the iPad has fallen below 40%. This transformation mirrors changes observed in the smartphone market and highlights the rapid growth of demand for affordable tablets in emerging markets. As low-cost Android manufacturers thrive, the iPad and Windows tablets face challenges that could reshape the tech landscape in the coming years.